Yesterday’s post (No margin for error) evoked a multitude of thoughts. Some readers have challenged the premise that the broader markets, especially the small-cap stocks, have sharply outperformed the large-cap components of the benchmark indices. They have argued that —

· Nifty Next 50 Index (YTD higher by ~21%), which comprises the top 50 stocks outside the Nifty50 (YTD higher by ~2.7%) universe, has performed much better than the Nifty Midcap100 (YTD higher by ~9%) and Nifty Smallcap 100 (YTD higher by ~10%) indices.

· If we exclude private banks and IT services stocks from the Nifty50 universe, the rest of it has performed better than the broader market indices.

· These statistics (index performance) completely fail to present a correct picture of the market. The narrative that small caps have done better than large caps is mostly false. On a risk-adjusted basis, large-cap stocks may have done far better than their smaller peers.

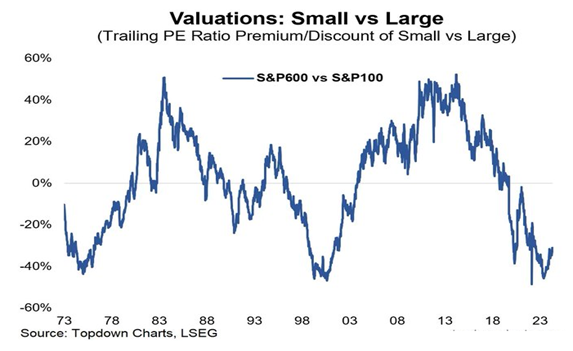

· Even in developed markets like the US, a few large-cap stocks have done extremely well and broader markets have underperformed sharply. The discount of small-cap valuation vs the large-cap valuation in the US markets is the highest since the dotcom burst in 2001.

In my view, all these are fair points. However, my premise behind “no margin for error” was entirely different. I wanted to communicate that –

(a) Presently, the small investors appear edgy to me. They have invested assuming a clear blue-sky scenario. Any sign of the dark clouds on the horizon would make them jittery and they might look to exit their positions.

Empirical evidence indicates that these small investors prefer to invest in smaller businesses where the chances of making big returns are significant. Besides, these investors have very low risk appetite. If the market witnesses a sharp fall, due to whatever reason, they may seek to exit their position. However, given that the liquidity dries very fast in the broader market their exits could come at a significant impact cost. On a bad day, the exit cost could be 20-50% more than what they would have assumed in a normal market scenario.

(b) A large section of these small market participants is indulging in option trading. The potential losses in the options segment could be substantially higher and permanent since the single stock options tend to become extremely illiquid in case of sharp moves in the underlying securities.

(c) The standard investing arguments – invest for the long-term; ignore intermittent volatility; small-cap yield a much larger return than large cap over a longer term, etc. – are very much true. However, it cannot be denied that human psychology and the personal circumstances of individual investors override these arguments. The forces of fear and greed dominate the day to day investment and trading decisions of individual investors. If the basic assumptions behind an investment decision fail or the overall market sentiments turn negative, the fear overwhelms the investing decisions of investors with a low-risk appetite. This is where most of the losses occur.

My favorite fund manager highlighted “NVIDIA is more volatile these days than even SME segment. More people would have lost money trading in NVIDIA than the number of investors who would have made money holding it. Trading is for mental wellness, while investing is for material gains”.

I cannot disagree with this proposition. I think most people would agree with it, in principle. But then how many of us live the way our parents and teachers guided us to do!!!