1H2025 was marked by stressful events, high volatility, and uncertainty. In geopolitics, several conventions were breached and new doctrines established. The war between Russia and Ukraine continued. India and Pakistan had a brief but intense conflict. The US entered the Middle East (Israel-Palestine) conflict by attacking Iran.

Climate wise, India had a mild winter followed by a mild summer, impacting crops. Europe continued to witness warmer weather, while the US, Canada, UK, Korea and several other countries in Africa witnessed intense and widespread wildfires, causing immense damage to the climate, lives of people and economy.

Politically, the US witnessed one of the most boisterous power transitions with Donald Trump taking over as the President (POTUS). He started his second term in the White House with radical changes in immigration, trade, and climate change policies. This put the US administration on the path to confrontations with citizens, judiciary, major trade allies (e.g., Japan, EU and China), strategic partners (E.g., Mexico, GCC, Canada and India). Towards the end of 1H2025, however things appear somewhat calming and progressing towards sustainable resolutions. The process of developing a new world order based on new ground realities and future prospects took a few more strides.

Technologically, Artificial Intelligence (AI) entered the lives of common men with Google and X (Formerly twitter) launching their user-friendly models. China launched DeepSeek to compete with ChatGPT (Open AI) and most social media platforms, search engines, financial and other services providers, integrating some sort of AI interface for the users.

Markets were volatile as the forces of hope and fear took turns to dominate the participants’ sentiments. In the end, the forces of hope appear to have emerged stronger. Most markets have recovered their losses and are progressing well on the path to growth.

In India, the economic growth returned to the normal pre-Covid trajectory, as the base effect of FY20 and FY21 low growth tapered off, and external challenges mounted. Equity markets settled close to their all-time high levels recorded in 3Q2024.

The following are some of the highlights of the performance during FY25.

Equity Markets

The Indian equity market managed to end 1H2025 with strong gains, despite yielding negative returns for three out of the six months. Indian equities performed in line with the European and US equities. The benchmark Nifty yielded a return of ~8% (9% in USD terms), which was better than the US markets (S&P500 +6%), Japan (Nikkei +1%) and Europe (Stoxx600 +7%) but much lower than South Korea (KOSPI +20%), Brazil (BOVESPA +14%) and Germany (DAX +20%). The valuation premium of Indian markets to the other emerging markets therefore remained elevated.

Financials saved the day for Indian benchmark indices

The benchmark Nifty (+8%) sharply outperformed broader markets (NSE500 +5.5%, Midcap Nifty 100 4.4%, Smallcap Nifty 100 +1.6%). The gains in benchmark indices were mostly led by banks (Nifty Bank +12.7%). Overall market cap of NSE was higher by 4.6%.

Sector-wise, Financials, Private Banks, Infra were top outperformers. IT Services, Realty, Pharma, FMCG, Energy were notable underperformers. Micro-sector-wise, Defense, Capital Markets, Healthcare, Fertilizers were outstanding. Renewable energy and real estate builders were notable losers.

1H2025 witnessed 3/6 negative months

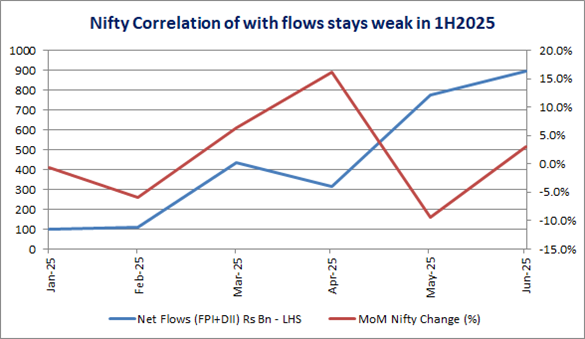

The benchmark Nifty50 yielded negative month-on-month (MoM) returns for three out of six months in 1H2025. April was one of the best months ever for Nifty, yielding a gain of 16% MoM. The market breadth was negative in three out of six months implying much higher volatility in the broader markets.

Institutional flows positive

Over institutional flows were materially positive for 1H2025. Net domestic and foreign flows in the secondary equity market amounted to Rs2630bn. Foreign Portfolio Investors (FPIs) were however net sellers of Rs945.36bn in the secondary market, while domestic institutions pumped in Rs3575.75bn. On an encouraging note, FPIs were net buyers in the last four months of 1H2025. The nifty-institutional flow correlation was very weak in 1H2025.

Debt and Currency Markets

Indian debt and currency markets were volatile in tandem with the global trend. The benchmark bonds managed to close 1H2025 with decent gains, the long-dated bonds were lower. USDINR ended almost unchanged, but EURINR, JPYINR and GBPINR were materially weaker.

RBI cut the policy rates by 100bps and Cash Reserve Ratio for commercial banks also by 100bps during 1H2025. The benchmark 10-year treasury bond yields eased to 6.31% from 6.80% at the beginning of the year. Lending and term deposit rates were lower by up to 10-25bps. The yield steepened sharply.

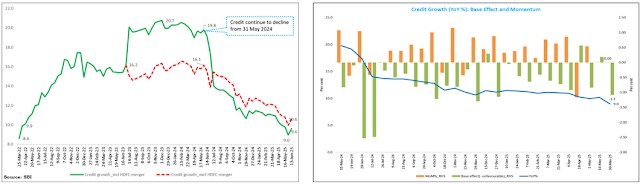

The RBI maintained its policy stance to “neutral”. The liquidity position remained comfortable with RBI conducting OMOs to keep the system liquidity in surplus. The credit growth continued to decline; however, there are signs of corporate credit demand picking up. Overnight and call money rates cooled ~50bps.

Economic conditions

4QFY25 GDP growth (+7.4% yoy) came sharply higher than the estimates. The consensus estimates for FY26E GDP growth however remain pivoted to ~6.5%. CPI Inflation mostly remained within the RBI’s tolerance band of 4-6% and has recently breached on the lower side. Core inflation has also eased. Real rates have mostly remained in positive territory during 1H2025. Fiscal deficit continued to decline. The private sector investments failed to gather the desired pace, despite several government incentives. The government capex showed some improvement in 1H2025. External conditions remained stable during 1H2025 despite geopolitical conditions remaining volatile. Lower trade helped the current account balance. However, BoP was briefly negative. RBI replenished most of its USD reserves, expended to support USDINR earlier in the year.

Commodities

1H2025 was a mixed period for commodities. Precious metals (Gold +26%, Silver 23%) and Copper +12.8, recorded good gains, while energy (Brent Crude -11%, Coal -12%), other metals (Steel -10%, Zing -8%) and soft commodities (Sugar -16%, Corn -11%) ended the period with strong losses.

Crypto shine

Cryptocurrencies further strengthened their position with material rise in trading volumes and market capitalization. Bitcoin ended the period 1H2025 with a strong 14% gain. More jurisdictions accepted cryptocurrencies as a valid medium of exchange, financial asset and/or tradeable asset.

No comments:

Post a Comment