In

this context, I would like to draw readers’ attention towards two particular

reports that I find representative of the analysis advising caution.

“Dotcom

on Steroids” by GQG Partners.

First

report, titled “Dotcom on Steroids” has been published by GQG Partners, USA.

This report draws parallels between the current AI-driven tech boom and the

dotcom bubble of the late 1990s, warning of similar risks ahead. The report

postulates-

“Today's

market, particularly in the tech sector, exhibits dotcom-era overvaluation, with

lofty multiples, slower earnings growth, and a weaker macroeconomic backdrop, in

our view

We believe

today's technology sector no longer represents forward-looking quality due to decelerating

revenue growth, collapsing free cash flow, and increasing competition.”

The

S&P 500 today trades at 23x TMF EPS—nearly the same as in 2000, but with

slower growth (10% vs. ~18% without any stimulus then). Most tech stocks already

trade at 1999-like multiples, unlike 1999’s budget surplus, the U.S. now faces

fiscal deficits, weakening the backdrop.

The

key points analyzed in these reports are as follows:

Rising Capital Intensity

Big

Tech’s capex now consumes 50–70% of EBITDA (similar to past telecom and energy

bubbles). This undermines the old thesis of tech as “hyper-scalable” with

minimal investment.

·

Microsoft

in 1999: traded at 60x earnings with 35% revenue growth, but took 15 years to

recover from the crash.

·

Cisco:

once the largest company during the internet bubble, driven by over-optimistic

growth projections—similar to Nvidia today.

·

Today’s

valuations (Nvidia, Palantir, ServiceNow) resemble bubble-era extremes.

Penetration driven growth hitting peak

“Most

of today's Al capital expenditures are funded by advertising revenue. Digital advertising

now accounts for more than 70% of all advertising, so the penetration-driven

growth story could be approaching its peak. Morgan Stanley expects the US digital

ad industry to grow at a 9% compound annual growth rate (CAGR) from 2025 to 2030-less

than half of its 20% CAGR between 2014 to 2019.”

·

Heavy dependence on AI-related

capex funded by cyclical advertisement revenues makes growth fragile.

·

Analysts fear AI giants may be

this generation’s “Nifty Fifty”—dominant but overpriced.

Competition

landscape changing

During

the 2010s, big tech was dominated by monopolies, e.g., Amazon dominated e-commerce,

and Google dominated search. This not valid today. All big companies directly

compete against each other in the same space. Cloud market is a good example of

the deteriorating competitive landscape. This was once a stable three-player market:

Microsoft, Amazon, and Alphabet. However, a disruptive fourth player (Oracle) just

entered in a big way and is explicitly undercutting peers on pricing by 40%. Adding

to the shakeup, CoreWeave-a financially constrained fifth player with an arguably

more cutting-edge product-has announced its intention to aggressively gain market

share through pricing pressure.

Big

tech is now incumbent not disrupter

In the

2010s, big tech were the disruptors. Today, big tech is the incumbent, while Al

is emerging as a highly disruptive force. AI winners would be known only a

decade or more later, just like the internet era winner (Meta, Google) was declared

several years after the bubble burst.

Conclusion: Tech is no longer uniquely superior in growth; risks of poor

investment outcomes are high if bought at inflated prices.

Voltage too high, be

cautious, Ambit Capital

Second

report titled, “Voltage too high, be cautious”, by Ambit Capital, India,

cautions that near term growth in the electrification of India theme are more than

priced in, but the mid-term risks like risks (slowing demand, BESS

substitution, subsidy phase-outs, rising global competition) are not yet

considered. It argues that better opportunities may exist outside the tech

sector with lower risk and similar returns.

·

Post-Covid

electrification boom (driven by transmission & distribution demand) created

supply-demand gaps and high margins for equipment makers. But these conditions

are peaking. Risks are rising beyond FY28 as growth slows, competition

intensifies, and margins normalize.

Demand–Supply Outlook

·

HV transmission equipment is

currently undersupplied, but heavy capacity expansions (transformers,

switchgear) will narrow the gap in 2–3 years.

·

National Electricity Plan (NEP)

targets show >30% decline in installations in FY27–32 vs FY22–27.

·

Battery Energy Storage Systems

(BESS) will reduce the need for fresh transmission infra post-2028.

·

Private capex remains muted

(capacity utilisation ~75%).

·

PGCIL capex plan accelerates

till FY28, then flattens.

Execution Risks

·

Land and regulatory delays

already caused FY26 targets to be cut.

·

Order growth likely to peak in

FY26–27, then plateau.

Policy Risks

·

Gradual removal of ISTS waivers

(inter-state transmission subsidies) will raise RE project costs and reduce

transmission demand.

·

Shift toward intra-state RE

sourcing could hit long-distance transmission growth.

Competitive Landscape

·

Local subsidiaries of MNCs like

ABB, Siemens, Siemens Energy gained share recently, but global majors

(Schneider, WEG, Nidec, Eaton, Delta) are scaling up aggressively. Schneider,

in particular, is expanding 2.5–3x capacity in India.

·

Export contribution shrinking

for most domestic players.

Margins

& Returns

·

Margins peaked in FY24; price

growth moderating.

·

RoCE expected to decline.

·

Multiples corrected from

Sept/Oct 2024 but still downside risks persist.

These

two are only representative reports. I find several such cautionary reports on

the rising (and unsustainable) high valuations, slowing growth, rising

household (retail) exposure to these high valuation stocks and sectors, elevated

macro concerns and explosive geopolitical conditions.

As has

been the case on every previous occasion, most market participants appear to be

believing that they still have some distance to cover before this bubble burst,

and they will be able to “exit’ well in time – regardless of the fact that it

has never happened in the past.

In my

view, the US market bubble is within striking distance of the needle.

Obviously, every market in the world will feel the tremor, whenever the US tech

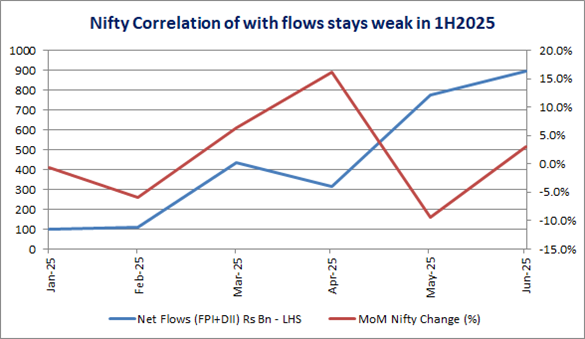

bubble bursts. India may be no exception. However, India is much better placed

this time compared to 2000, because the Indian markets have been

underperforming the global markets for the past one year, FII holdings is now

at lowest level since the global financial crisis, speculative activities have

reduced materially due to consistent regulatory intervention, Indian markets have

insignificant exposure to high-tech sectors like AI, Cloud, semi-conductors etc.,

and a large part of Indian markets is still reasonably valued (though not

cheap).

More

on strategy for the Indian markets, next week.

Dark clouds gathering on

the horizon – 1

Dark clouds gathering on

the horizon - 2