The weather in the market has changed rather

dramatically over the past two weeks. As we changed the calendars about four

weeks ago, it was a partially clouded sky, but no one was forecasting a

hailstorm, the markets are witnessing for the past 6 trading sessions. Seven

odd percent fall in the benchmark Nifty is certainly not indicative of the

damage that has been caused to equity investment portfolios, as the theater has

been mostly outside the Nifty.

The sharp correction in equity prices is

nothing unusual. In fact it has been a regular feature of the markets ever

since the advent of public trading of corporate. However, in modern times this

volatility assumes a wider socio-economic significance because the markets have

become increasingly democratic. The access to the market is no longer confined

to an elite section of the society. Investors in listed equities now come from

all walks of life – young college students to old pensioners and top metros to

the poorest districts of the country.

No surprise, the policy makers afford

significant importance to the “markets” and markets also expect undivided

attention from the policy makers like a possessive child. The markets begin to

throw tantrums if they get any hint of likely coercive or disciplinary action

from the policymakers.

Moreover, social media has not only made

markets more sensitive to the flow of information; it has also made markets

more susceptible to manipulation by vested interests. The market participants

are often inundated with incoherent data from across the globe, invoking “fast

finger first” type reactions from traders. Robotic traders, which account for a

significant part of the market activities these days, often follow the herd and

accelerate the prevailing trend.

As per the popular commentary, the market fall

in the present instance is precipitated by the following “factors” and/or

“fears”:

(a) The

US Federal Reserve (The Fed) is expected to end its bond buying program that

was started in 2019, and begin hiking the policy rates from March onwards. It

is expected that these Fed policy actions may result in higher bond yields and

tighter liquidity leading to unwinding of USD carry trade. This shall lead to

outflow of foreign funds from emerging markets that have benefitted from the

deluge of liquidity created by central bankers of developed countries.

In this context, it is relevant to note that:

(i) This

move of the Fed is most anticipated since the past many months. The markets are

known to act in much advance of these anticipated events and rarely wait till

the last minute.

(ii) The

foreign investors have been net sellers in the Indian secondary markets for

most of the current financial year. In fact, in the past 13months they have

already sold Rs1.1trn worth of equities.

(iii) The

empirical evidence indicates that the Fed rate hike cycles usually lead to

higher equity prices.

(iv) Indian

bond yields have already risen sharply over the past six months. Even if the

Fed raises 50-75bps over 2022, the yield differential will still be attractive

for the foreign investors.

(v) In

2021, the last action of 17 central banks was a hike in rate, and none reduced.

In spite of this, markets made all-time highs across the world.

(b) There

could be a Lehman like collapse or a dotcom like bust in the market.

The global central bankers have learned their

lessons well from the global financial crisis. From the Greek sovereign crisis

to Evergrande default, there is sufficient evidence to support their ability to

mitigate the contagion impact of any major failure.

Insofar as the valuation bubble is concerned,

we have already seen 50-70% correction in numerous inflated assets/stocks in

the past three months, while global indices were recording new highs every day.

The ability of markets to handle sectoral busts is certainly much better than

the dotcom era of 2000.

(c) Hyperinflation

is upon us and financial assets will lose their value.

The global experts are still struggling to

define whether the current episode of inflation is supply driven or demand

pulled. The helicopter money that led to sudden spurt in demand has been

largely exhausted. It is paradoxical to assume that no more helicopter money

would lead to price erosion in the equity market but continue to fuel inflation

in goods markets. The growth has already moderated world over and logistic

constraints are not structural enough to last for years. Technology that has

been the biggest deflationary force in the world continues to advance.

The traditional inflation hedges like gold have

shown no sign of heating in demand. The German and Swiss benchmark yields are

still negative and Japanese bonds are witnessing no bear attacks. The Chinese

central bank has lowered rates.

(d) There

could be a full-fledged war between Russia and NATO allies.

Neither the conflict at Yatseniuk’s Wall

(Russia and Ukraine border) is new; nor is the conflict in Middle East Asia

new. The bogeyman of WDM (Weapons of Mass Destruction) in Iraq killed almost

every chance of significant united NATO action two decades ago. Russia invaded

and annexed Crimean peninsula from Ukraine in 2014. The US and Russian

relations have shown no apparent signs of deterioration post that. The German

Navy Commander recently revealed the German thoughts on potential

Russia-Ukraine conflict.

(e) The

pandemic effects are unknown. The rising inequalities and poverty will plunge

the world into chaos.

There is sufficient empirical evidence

available to show that the rising inequalities have benefitted the larger

companies and therefore stock markets. The world has been a chaotic place for

at least the past 2 million years. In fact the past two decades perhaps have

been the most peaceful period in the post Christ era.

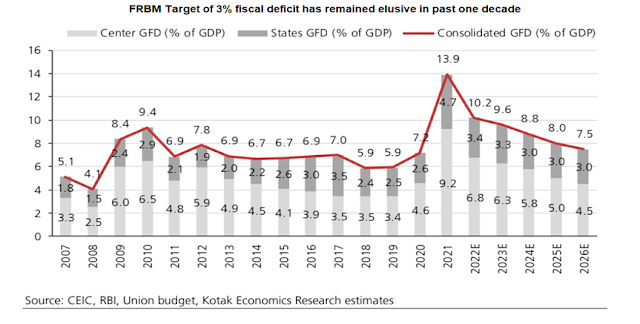

(f) The

finance minister may impose new taxes in the budget to manage the resources for

populist agenda of the government.

The Union Budget actually ceased to be an

important event many years ago. Indirect taxes are mostly no longer part of the

budget now. Direct taxes are mostly rationalized and have little scope for

tinkering. Fiscal data is announced every month and it is easy to estimate the

deficit and borrowing figures on a regular basis. Usually there are no negative

surprises on this account in the budget.

This time particularly, the finance minister is

in no position to cut tax rates and it can hardly afford to hike taxes. There

could be some minor tinkering here and there, but nothing major should be

expected. The fiscal deficit figure will account for Rs 1trn from LIC IPO,

which is not certain. Obviously, assessing the accounting part of the budget

may be difficult.

Obviously, the market behavior is not in

congruence with the narrative. If the investors were truly fearful about the

factors they are talking about, then they must have moved towards the shelter

(defensive and deleveraged) from the cyclical. Whereas, in 2022 so far, IT,

Pharma, FMCG have been the worst performing sectors and cyclical energy and

financials which mostly face the brunt of tightening money cycle have performed

the best.

In my view, the markets are fearful because (a)

they are feeling guilty about the excessive greed shown towards internet and

renewable energy; and (b) a large majority of investors lacking in conviction

would have followed the pied pipers rather than making an informed decision

about their investments, are falling in the ditch.