Some food for thought

"My dear friend, clear your mind of cant."

—Samuel Johnson (English writer, 1709-1784)

Word for the day

Cant (n)

Hypocritical and sanctimonious talk, typically of a moral, religious, or political nature.

First random thought this morning

Three popular business models have caught my fancy in past

two decades.

First is the most popular Google model. In this model, the

business uses the classical cross subsidization model to build a captive and totally

addicted (enslaved if you like that better) customer base, and then exploit

these captivated customers at will.

Google first offered an amazing bouquet of free services to all.

Once a critical mass of captivated free users was attained, Google started

subsidizing the cost of free services through advertisement revenue it earned

from businesses who wanted to sell their goods and services to the captivated

audience. Now having gained access to the eyes, ears, homes (including

bedrooms) pockets and minds of over a billion users, Google is offering a host

of services to this enslaved audience.

Second model is the Chinese trade model. In this model, the

vendor first engineers a shift in the supply source to itself. The task is achieved

by a variety of means, like compromising the interest of environment & sustainability,

exploiting labor, evading taxes, offering and manipulating the exchange rates.

In the second leg, the vendor engineers the demand for its product by offering

lowest prices and easiest credit terms to the buyers.

China first engineered the shift of factories to its land from

all over the developed world. Then it copiously funded the fiscal deficit of the

governments of its top consumers, helping sustenance of easy monetary policies

and abundant credit to consumers. It then flooded their markets with cheapest

priced goods to the leveraged customers.

The third model is the most interesting model. It relates to the

business of politics. I am not a well read person. With my limited knowledge, I

believe that this model has been developed by Mrs. Sonia Gandhi, the former

president of the Indian national Congress. Under this model, the leader of the

enterprise enjoys all the authority and remains beyond any accountability. All

the accountability is owned by the foot soldiers, well trained and conditioned never

to challenge the authority of the leader.

All these models, which have defined our economic, social and

political behavior in past 10-15years, are facing serious sustainability challenges

in recent times.

The voices of concern over Google's hegemony are rising louder

in west.

President Trump is seeking to demolish the Chinese trade model

completely.

Prime Minister Narendra Modi is held accountable for everything

happening or not happening in India, including instances of drains chocking in

rains, electricity transformer breakdowns, loss of BJP in JNU elections, etc.

It would be interesting to see how our future generations would be

able to cop without free Google, Social Media, Voice Calling and cheap Chinese

manufacturing. Greater accountability and less powers may also change the

political narrative completely.

Nurturing Raktabīja

The eighth chapter of "Durga Saptashati", one

of the most sacred Hindu religious scriptures, is about the annihilation of a

mighty demon called Raktabīja by the Mother Supreme.

Raktabīja, a very strong demon, had a boon that whenever a drop

of his blood would fall on earth, a clone of his would be born at that spot.

Each such clone will be equally powerful and demonic in character. So it was

almost impossible for anyone to defeat this demon in a fight. Eventually, the

Mother Supreme, along with her many divine manifestations, was able to

annihilate the demon, but not before he had caused immense damage to the forces

of gods.

I will come to why I am reminded of this story this morning, in

a moment.

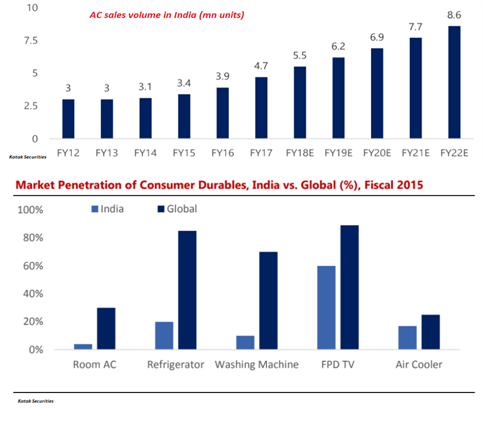

As per a latest research reports, "India's air conditioner

market is poised for solid growth with a CAGR of over 17% over the next five years." (See here)

International Energy Agency (IEA) in a recent report highlighted

that "The growing use of air conditioners in homes and offices around the

world will be one of the top drivers of global electricity demand over the next

three decades." (See

here)

According to a recent IEA report The Future of Cooling, , "global

energy demand from air conditioners is expected to triple by 2050, requiring

new electricity capacity the equivalent to the combined electricity capacity of

the United States, the EU and Japan today. The global stock of air conditioners

in buildings will grow to 5.6 billion by 2050, up from 1.6 billion today –

which amounts to 10 new ACs sold every second for the next 30 years."

Growth in the India’s air conditioner market is anticipated on

account of rising demand for air conditioners from residential as well as

industrial sectors, extreme climatic changes and emergence of latest

technologies in air conditioners, such as inverter technology and smart air

conditioners, according to a TechSci Research report.

As per some estimates, Indian electronics market is expected to

grow at 41% CAGR between FY14-FY20 to reach US$400bn. Consumer electronics

exports from India is also growing gradually, and is already in excess of

US$250mn.

Some of the key drivers cited for the likely non-linear rise in

the consumer durable in general, and air conditioners in particular, are as

follows:

(a) Change in weather

patterns. Longer and intense summers, even in some hilly areas and traditional

cooler cities like Bengaluru.

(b) Greater and more

predictable electricity supply.

(c) Rise in

affordability, as income levels of middle class households rise.

(d) Change in

air-conditioning technology, motivating replacement demand in favor of modern

energy saving air conditioners.

(e) Changes in trade

and consumption patterns. For example, rise in (a) organized retail formats,

(b) processed food consumption, (c) office space for ITeS industry and modern

manufacturing; etc.

(f) Modernization of

public transport, etc.

The listing of couple of white label electronic goods

manufacturers in past one year has enhanced the market interest in this sector

significantly; even though the consumer durable market has been witnessing good

growth for past few years.

As an "Investor", I am faced with a serious dilemma

here.

I can clearly see, that consumer durable market, especially

air-conditioning market, is going to grow exponentially in next few years; just

like the way motor cycles, mobile phones and single family apartment markets

have grown at various point in past 25years.

The dilemma before me is that I see air conditioner as a product

which is similar to the mythical demon Raktabīja. For, every few ACs

sold may be generating demand for another AC.

No, I am not talking about the vanity issues or household

rivalries here. I am trying to highlight a serious sustainability issue.

Each air conditioner installed in a house, mall or factory,

generates tremendous amount of heat outside the premises it is cooling. That

heat goes on to raise the outside temperature and thus forcing demand for more

air conditioners. It is a vicious cycle that shall go on endlessly.

Of course other factors such as rising vehicle population,

deforestation, etc. are equally responsible for rising temperature, but I find

air conditioners to be more demonic, as I do not yet see anyone highlighting

this as a serious concern.

In recent exercise to rationalize the GST rates, the GST council

reduced the tax rate for air conditioners. It is for the first time, the

government has recognized air conditioners as a non-luxury item. We may

therefore see more incentives for the industry, enabling it to grow even

faster.

No denying that at this given point in time, air conditioner is

becoming an essential household appliance, just like refrigerator or cooking

gas.

But the point to ponder is how did it become an essential item,

and how would we ever get rid of this!

In the meantime I am wondering "Should I shun AC

manufacturers and sellers, just the way I do with the tobacco sellers!" or

"Should I seize this opportunity to invest in these firms and make some

money so that I can install some air conditioning in my toilet too!"