Mr. Bond no longer a superstar

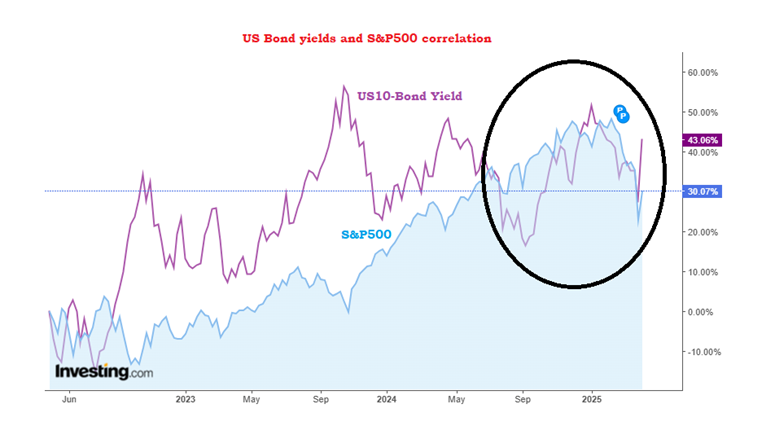

The conventional market wisdom suggests that the bonds usually lead the change in market cycles. Traditionally traders have closely followed the yield curve shape, benchmark (10 year) yields and high yield credit spreads to speculate the near term moves in equity, currency and commodity markets. Two simple reasons for this traditional practice are – (i) Bond markets are usually more correlated with the economy. (ii) Size of bond markets is materially larger than the equity, currency and commodity markets. It has the largest number of leveraged positions at any given point in time; and most of the large and influential market participants are more active in bond markets as compared to the other markets. I am however inclined to disregard this piece of conventional wisdom. In my view, it would make sense only if the markets are operating in a free and fair manner. In cases where the central bankers and governments (through Sovereign Wealth Funds and o...